Next Gen M&A

Combines investment banking expertise, proprietary data, and a cloud-based deal management platform to help companies achieve growth through strategic transactions

of deals completed by Danescor

clients are off-market

Average buy-side client completes

1-2

deals per week across our platform

Private Equity

Danescor collaborates with PE firms to:

- Identify new investment opportunities via their proprietary deal-sourcing tools and sector research

- Identify and transact on bolt-on acquisition opportunities

- Provide deal-management valuation support and due diligence for buy-side and sell-side deals

- Identify buyer landscapes and exit strategies for portfolio companies

- Create and project manage medium to long-range M&A roadmaps

Business Owners

Danescor supports owners of mid-market businesses by:

- Delivering precise company valuations and transaction receipts

- Sharing post exit financial planning strategies by identifying and engaging with best-fit buyers to maximise realizations

- Providing end-to-end transaction support minimising risk and leakage

- Creating and delivering comprehensive acquisition strategies and programmes

Corporations

For corporations, Danescor provides:

- Sophisticated identification and engagement with strategic acquisition targets

- Proprietary M&A counterparty data and data services

- End-to-end transaction support via on-demand investment banking services

- Independant valuation services for corporate development teams

- Assistance and delivery for non-core asset divestitures

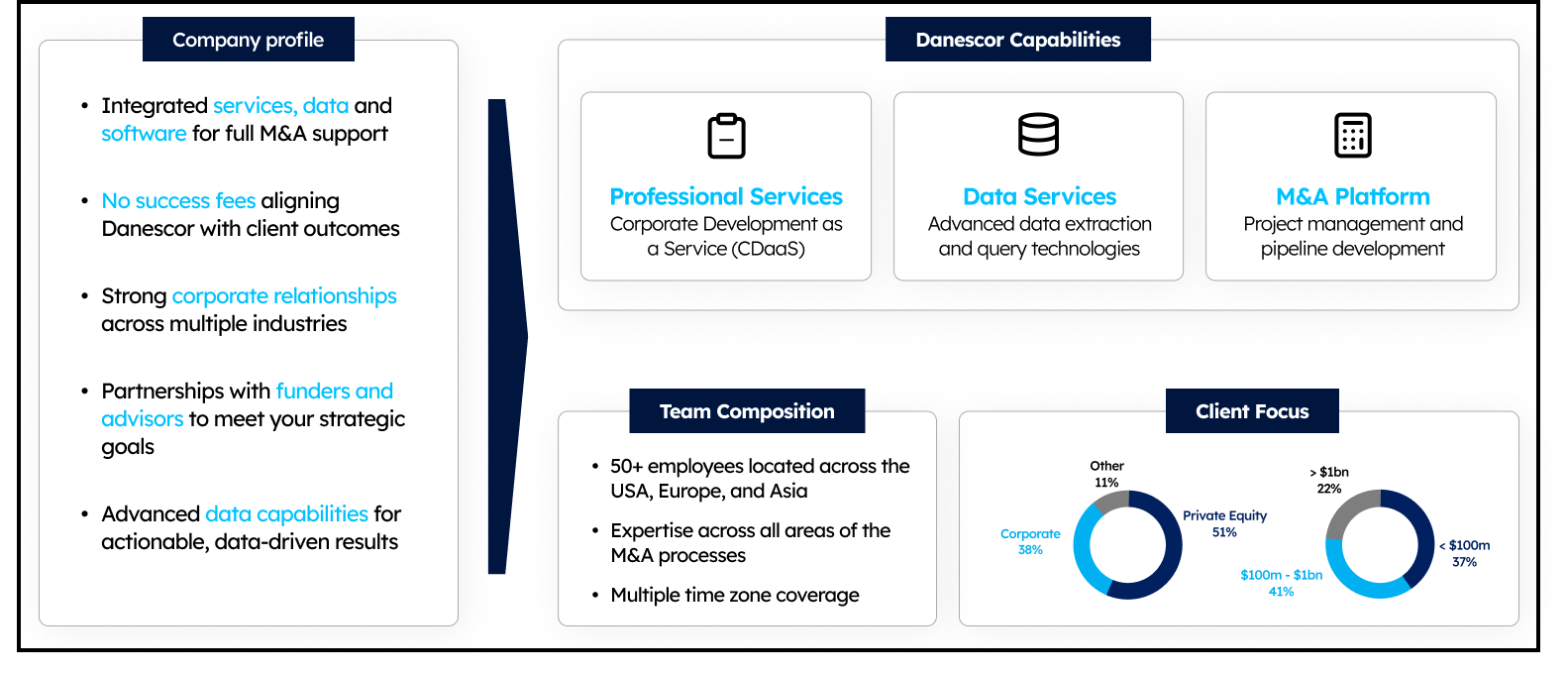

Danescor is a leading provider of M&A services and transaction support. Our hybrid offering combines investment banking professional services, proprietary data and deal management software.

How We Do It

How We Do It

Enhanced M&A process

We work with C-suite and corporate development teams to super charge the efficiency and effectiveness of their acquisition strategies

Danescor supports the most active buyers in their sectors

Client Testimonials

Frequently asked questions

How Does Danescor deliver Corporate Development as a Service?

We deliver end-to-end services in a modular format to execute an M&A pipeline. Clients determine which services are required and at which stage either through our full outsourced offering or an extension of their internal M&A teams.

How can Danescor help me?

Seamless combination of M&A professionals, software and data analytics, to help you achieve a comprehensive market-scan in-order to focus on the top quartile ROI prospects.

End to end M&A capabilities – whether it’s target outreach & engagement, target evaluations, DD, PM we provide a complete set of skills and services which can be leveraged at any point.

Retainer pricing model – our sole focus is on finding best fit targets, not pushing any one deal to generate a payout.

What can I achieve with Danescor?

We undertake a comprehensive process to uncover, manage and progress the best fit opportunities.

Most commonly Danescor runs an M&A funnel for clients containing mid to high hundreds of prospects, with clients on average completing more than three acquisitions a year and many into double figures..

What type of companies work with Danescor?

Our clients range from multi-billion dollar corporates, with sophisticated in-house resources to pre private equity owner managed business looking to complete their first acquisition. Primarily we work with companies who have decided that acquisitions are a meaningful component of their growth plans.

Our proprietary market data and leading edge transaction management software efficiently leverages the output delivered from our experience professional services team.