pink-ape-182059.hostingersite.com

Corporate Development as a Service

Our hybrid offering of data, software and M&A services can be delivered on an as needed bespoke basis to enhance and accelerate your strategic M&A program

From origination, evaluation to completion, our Corporate Development as a Service enhances your M&A process and supports sustainable growth

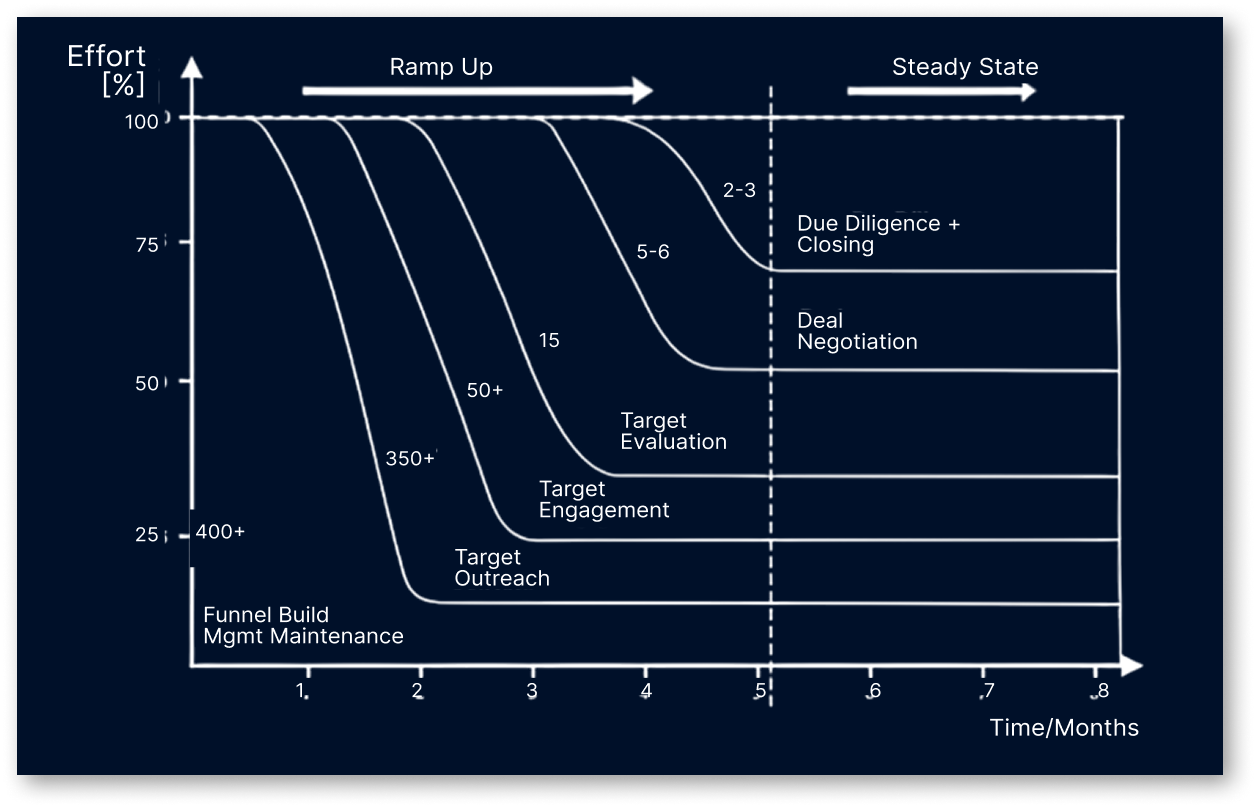

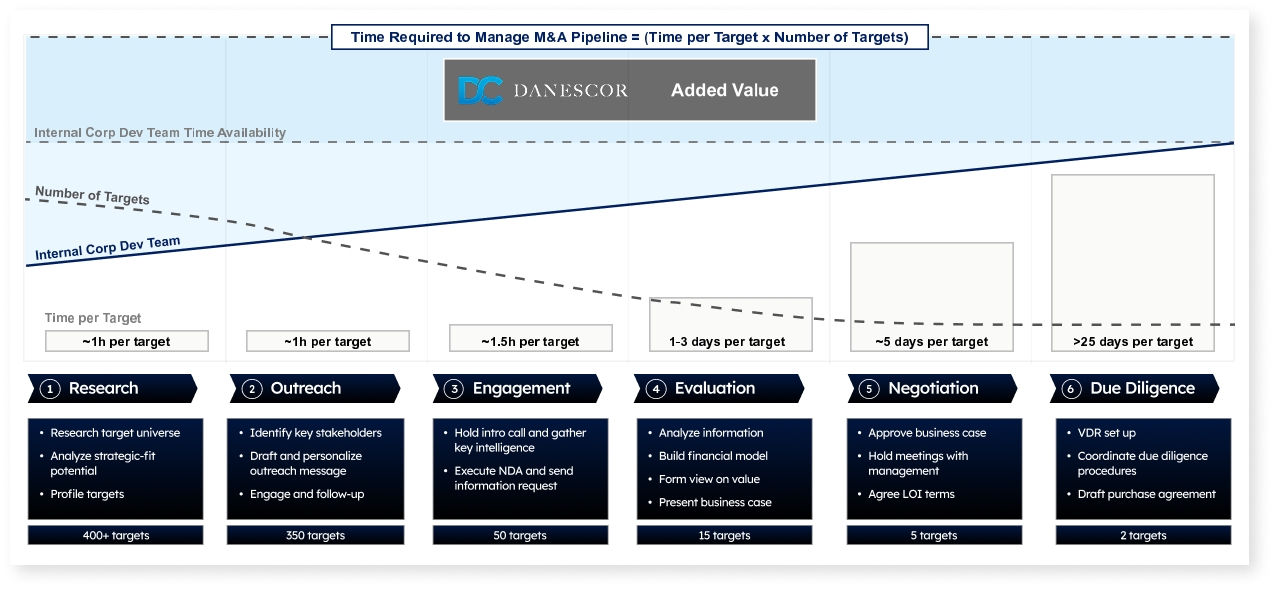

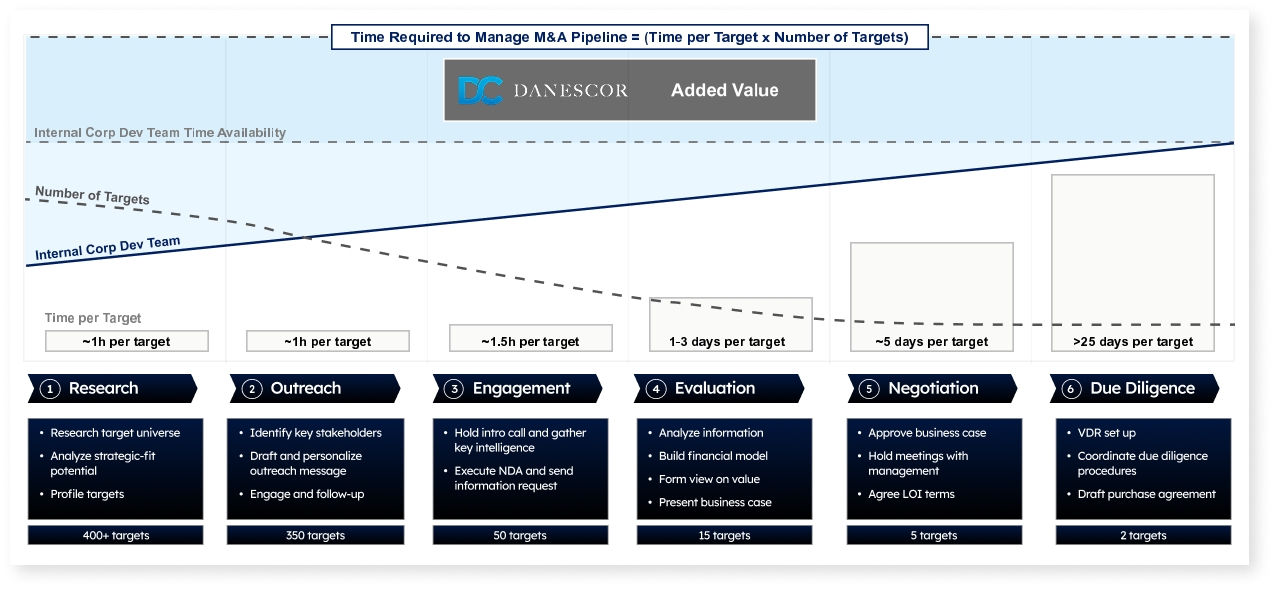

Corporate Development as a Service - Time Allocation

Danescor can add value at every stage of the M&A process, enabling senior client executives to focus on the most value-adding activities

Key benefits to your organization

Cost effective solution

By leveraging our CDaaS offering, you will access high-level expertise without the overhead costs. Our service can be utilized end-to-end or as an ‘on-demand’ basis.

Faster execution

Our efficient processes and ‘on-demand’ professional resources enable companies to accelerate their growth strategies.

Focused growth

Clients are able to focus on their core operations while benefiting from our specialized support in their corporate development growth strategies.

Scalability

Organizations can easily scale up or down their corporate development activities based on their requirements, making it a flexible and cost-effective option for growth management.

Key Features of Danescor’s Corporate Development as a Service

How we assist with your strategic planning?

We help with stepping through a rigorous strategic review process to identify the ideal acquisition criteria.

Our deal sourcing strategy?

Discover potential acquisition opportunities which are outside of formal adviser led sale processes.

Our due diligence expertise?

Danescor offers expertise in conducting thorough due diligence for potential transactions, helping clients assess the viability and risks associated with various targets.

Valuation and Financial Analysis service?

This includes comprehensive valuation models and financial analyses to support informed decision-making. Clients receive insights into pricing negotiations and deal structuring.

Danescor’s superior market intelligence?

Through our proprietary data and market analysis, Danescor offers insights into industry trends, competitive landscapes, and market dynamics, which are crucial for informed decision-making.

Our on-demand professional offering?

Our team comprise of M&A advisors, due diligence professionals, valuation experts, data scientists and data engineers.

Key Features of Danescor’s Corporate Development as a Service

1. How we assist with your strategic planning?

We help with stepping through a rigorous strategic review process to identify the ideal acquisition criteria.

2. Our deal sourcing strategy?

Discover potential acquisition opportunities which are outside of formal adviser led sale processes.

3. Our due diligence expertise?

Danescor offers expertise in conducting thorough due diligence for potential transactions, helping clients assess the viability and risks associated with various targets.

4. Valuation and financial analysis service?

This includes comprehensive valuation models and financial analyses to support informed decision-making. Clients receive insights into pricing negotiations and deal structuring.

5. Danescor’s superior market intelligence?

Through our proprietary data and market analysis, Danescor offers insights into industry trends, competitive landscapes, and market dynamics, which are crucial for informed decision-making.

6. Our on-demand professional offering?

Our team comprise of M&A advisors, due diligence professionals, valuation experts, data scientists and data engineers.